Project Description

The job-creating entity (the “JCE”),American Industrial Brands, LLC (AIB), will utilize EB-5 capital for the construction and development of their facility located in Kokomo, Indiana.

The Kokomo facility is currently undergoing substantial renovations encompassing both the exterior and interior. These renovations entail upgrading the building’s water use systems, electrical systems, fire protection systems, and plumbing systems. Additionally, attached building equipment such as storage silos, air systems, and lighting will be repaired or replaced as needed. Ongoing Projects include roof maintenance and replacement, exterior painting, parking improvements, energy efficiency enhancements, installation of security cameras, and a comprehensive overhaul of the kiln.

At its facility in Kokomo, Indiana, the JCE specializes in manufacturing high-efficiency bathroom fixtures. These fixtures encompass:

-

Toilet Bowls & Tanks

-

Urinals

-

Sink Basins

-

Bathtubs and shower pans

The JCE is directly involved in producing all the components associated with the aforementioned fixtures. These components include:

-

Fill Valves

-

Flush Valves

-

Toilet Trim Components

The JCE also provides warranties on its products and offers repair solutions to customers. The aftermarket repair solutions represent a profitable revenue stream for the JCE. Construction is currently underway at the facility, and as a result, the facility is already engaged in the production and importation of the aforementioned products. The JCE’s management estimates that the construction progress is at 75% completion. Once the Project is fully finished, the management anticipates that it will increase the JCE’s capacity to produce up to 1.1 million units. This expansion will result in a 36% increase in the JCE’s overall production of toilets and bath fixtures within the U.S.

Project Location

The Project is located in Kokomo, Indiana. This location reduces shipping costs and distribution timelines as it can reach over 80% of the U.S. population within one day of freight delivery. The Project’s location in Indiana offers the advantage of lower shipping costs compared to foreign competitors when targeting U.S. markets.

By choosing Kokomo as the location, ample logistics coverage can be achieved in the Midwest, the Upper East Coast of the U.S., and Eastern Canada.

Additional distribution center locations include Charleston, South Carolina, Knoxville, Tennessee, and Little Rock, Arkansas. These centers cater to the East Coast, the Caribbean, and the Southern and Southwestern U.S.

Figure 2: Map of Kokomo (source: Business Plan)

Project Timeline

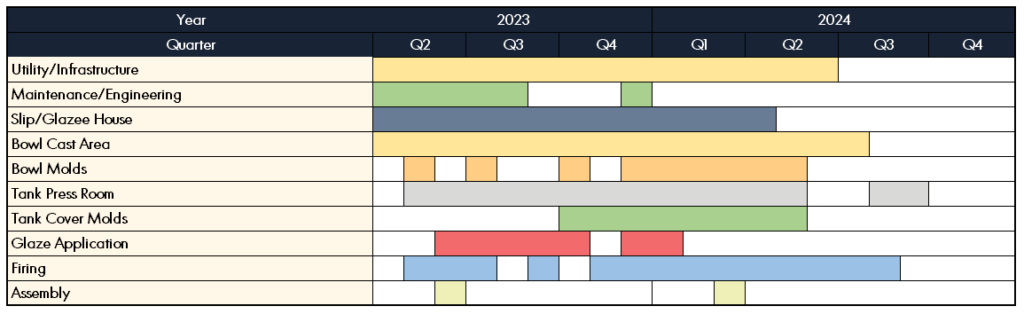

The timeline to complete the plant is estimated to take up to 18 months.

Figure 3: Project Timeline (source: Business Plan)

Job Creation & Allocation

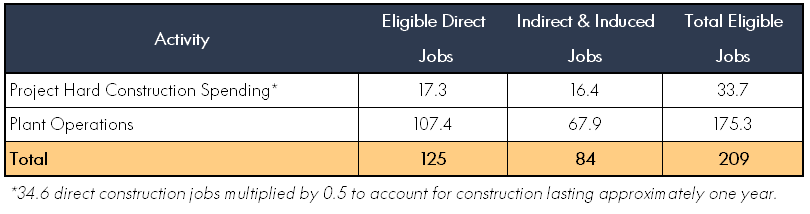

The anticipated 16 EB-5 investors will require a total of 160 jobs. Based on the Project’s budget of $27 million, the Project will generate an estimated total of 209 EB-5 qualifying jobs, resulting in an excess of 49 jobs, or a 31% job cushion. The funds from the previous investment made under the direct EB-5 program have already been deployed and are not included as an input in the econometric analysis.

The economic impact calculations were prepared using the most current RIMS II model and multipliers specific to the JCE’s region. The economic modeling approach assigns costs for each expense category and applies them to the appropriate industry multipliers. Revenue is also applied to its respective industry multiplier. The report adheres to industry best practices to facilitate adjudication.

Figure 4: Project Impacts (source: Business Plan)

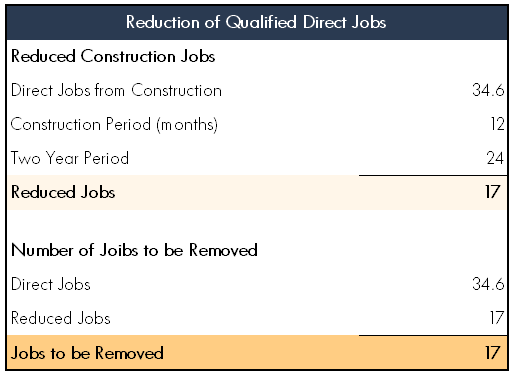

The Reform and Integrity Act of 2022 permits a maximum of 90% of the jobs to be created indirectly. However, there are specific limitations on how jobs resulting from construction activities lasting less than two years can contribute to the estimated count of indirect and direct jobs. If the construction period is less than two years, only 75% of the jobs can be attributed to indirect jobs. In other words, a minimum of 25% of the total jobs must be direct. Additionally, direct jobs stemming from construction lasting less than two years can be included but need to be adjusted based on the fraction of the construction period exceeding two years. The EB-5 investors can utilize this adjusted number of direct construction jobs to fulfill the requirement that 25% of the overall jobs must be direct.

Figure 5: Calculation of the Job Reduction from Construction

The construction phase is expected to last approximately 12-18 months. For the economic impact calculation, a conservative assumption of a 12-month construction duration was utilized. Consequently, the number of direct jobs resulting from construction has been adjusted to 17.3 jobs from the original estimate of 34.6 jobs. The remaining direct jobs to be considered for the EB-5 investors is 124.7, achieved by reducing the direct number of construction jobs by the fraction of the construction period.

The collective group of EB-5 investors requires a total of 160 jobs, with 120 jobs (75% of 160) allowed to be indirect jobs and 40 jobs needed to be direct jobs. The number of direct jobs noted above is 124.7, which exceeds the required 40 direct jobs.

Qualifying jobs directly created by the previous Project have already been assigned to the respective EB-5 investors. The current Project’s job calculations, performed using econometric methods, do not include any jobs resulting from the previous Project. Jobs generated by the current Project will be exclusively allocated to EB-5 investors participating in this offering.

Job Allocation

Jobs created by the Project will be allocated in the order of each EB-5 investor’s admission to conditional residence. Qualifying jobs directly created by the previous project have been allocated to the direct EB-5 investors.

Permits & Approvals

To obtain certificates of occupancy for the Project, the buildings must undergo inspections and receive additional permits, certifications, and approvals related to building and fire safety, sanitation, and accessibility.

During the construction and operation of the Project, the JCE must adhere to numerous regulations concerning worker health and safety, as well as environmental guidelines. This includes, but is not limited to, ensuring that all Project construction is carried out in accordance with the guidelines and regulations established by the Indiana Occupational Safety and Health Act, the rules and regulations of the U.S. Department of Labor, and the Indiana State’s Environmental Policy Act.

All permitting will be handled by the general contractor, CST Construction.

Project Key Agreements

The JCE has entered into several key agreements that are integral to the operation and performance. Below, provide a description of some of these significant agreements.

Management Service Agreement with Briggs Plumbing Products, LLC

The JCE has established a Management Service Agreement with Briggs Plumbing Products, LLC (“Briggs”), under which Briggs will offer a range of managerial services to the JCE for a monthly fee. These services encompass general secretarial tasks, bookkeeping and record-keeping, support for financing activities, human resource functions including employee recruitment, payment collection and settlement, as well as legal advisory services.

Lease Agreement

The JCE has established a Lease Agreement with Coast RE, LLC, a subsidiary in which it holds a 94% ownership stake. Coast RE, LLC possesses ownership of the real property, fixtures, and equipment of the Kokomo manufacturing facility. As per the terms of the Lease Agreement, the JCE is granted exclusive use of these facilities provided by Coast RE, LLC.

Sources & Use of Funds

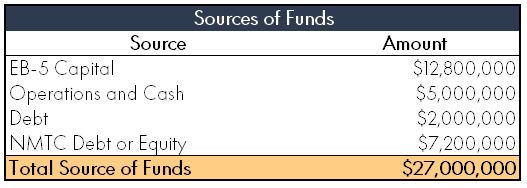

Project’s Source of Funds

The JCE expects the Project to require a capital development budget of approximately $27 million. In addition to EB-5 capital, the Project is anticipated to be financed through reinvestment of cash flow generated from ongoing project revenues, debt, and New Market Tax Credits (NMTC).

Figure 6: Source of Funds (source: Business Plan dated December 2022)

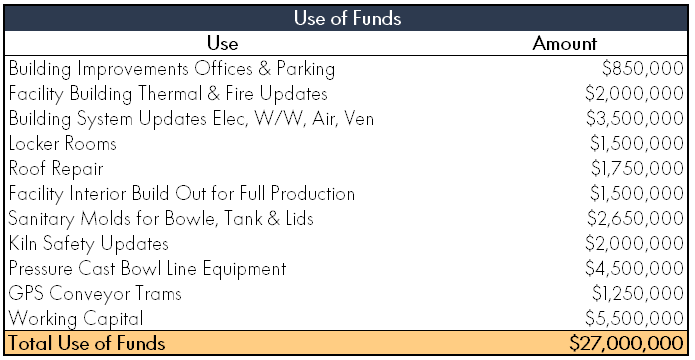

Use of Funds

Figure 7: Use of Funds (source: Business Plan dated December 2022)

The funds raised from this offering will be directly allocated to cover the Project costs. This includes the utilization of up to $12,800,000 in bridge financing to cover Project expenses while awaiting the proceeds from the offering.

Financial Projections & Assumptions

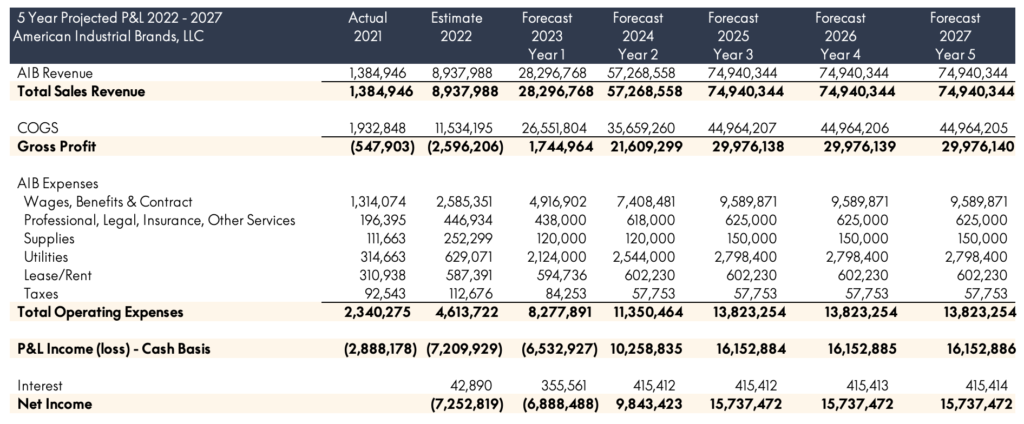

The provided figures display the projected profits, cash flow, and units produced by the JCE for the upcoming six years. These financial projections have been prepared by the JCE’s management. The financial projections are based on current expectations and assumptions, and, like any financial projections, they inherently involve various risks and uncertainties.

Figure 8: Financial Summary (source: Business Plan)

The revenue segments include the Kokomo plant, sales from imported products, and the sales of Jason branded bathtubs. Production at the plant is expected to commence in Q2 2023. Sales and expenses in 2021 and 2022 are attributed to the Jason branded bathtubs and sales of imported products.

AIB is anticipated to operate at a net loss during 2022 and 2023, with projected losses of $7.25 million and $6.89 million, respectively. Sales are projected to experience a significant increase in 2024, with estimated revenues reaching $57.27 million and net income reaching $9.84 million. From 2025 to 2027, revenues are expected to stabilize, with a projected revenue of $74.94 million and a net income of $15.74 million.

The management believes that AIB will achieve substantially higher gross margins compared to competitors due to the cost-saving benefits resulting from integrated manufacturing and robotic cast molding, surpassing those of other American-made pre-finished fixtures. Gross margins are expected to increase significantly starting from the second year and onwards.

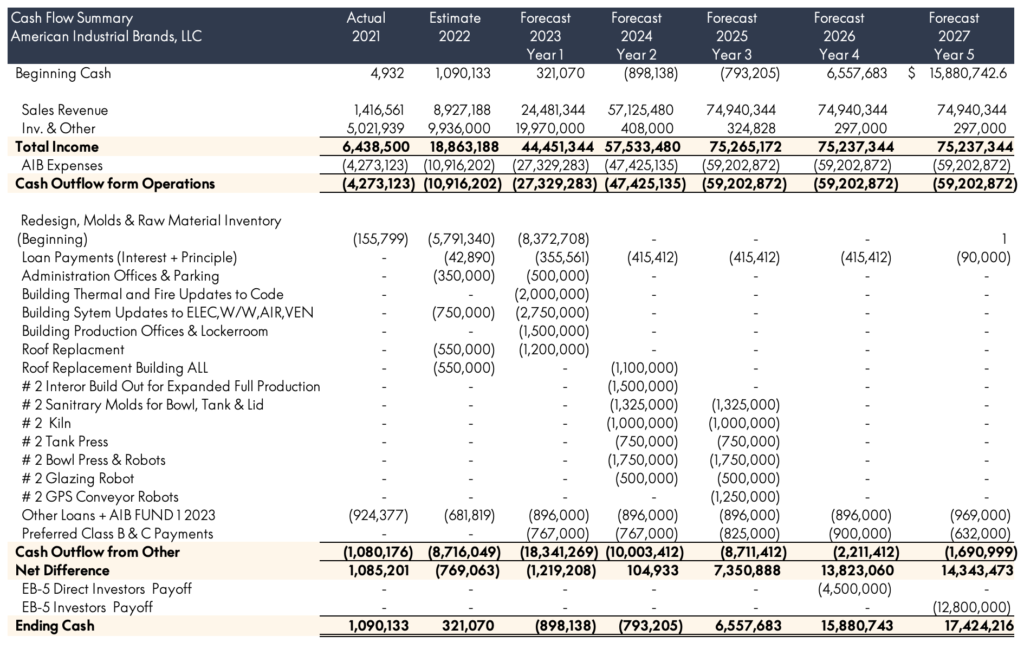

Figure 9: Cash Flow Summary (source: Business Plan)

AIB plans to make improvements and invest in construction initiatives over a phased period. The model outlines the cash flow of the build-out process. AIB anticipates achieving positive cash flow starting from second year and onwards. Furthermore, AIB has formulated plans to repay the EB-5 investors by Year 5.

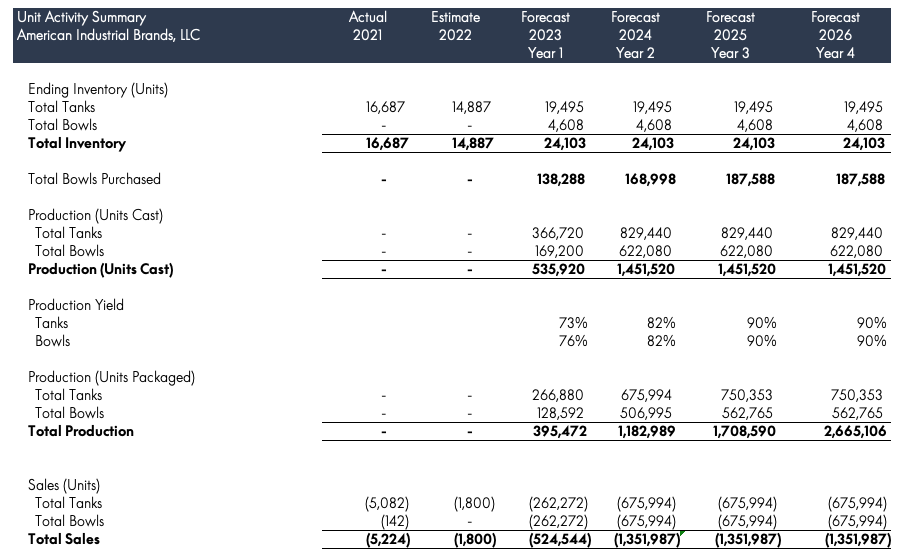

Figure 10: Units Activity Summary (source: Business Plan)

The figure provides information on the production levels for the next four years and the corresponding yield percentages. The yield percentage represents the proportion of produced units that will be sold to end consumers. An important assumption in the forecast is that all units produced and packaged (after applying the production yield) will be sold. These two assumptions play a significant role in the forecast and will be further discussed below.

Assumptions

Prices

The financial projections relies on estimated average prices of bowls and tanks to calculate sales revenue. These average prices remain constant until Year 5. Key members of the management team, who possess over 20 years of industry experience, have determined these prices based on historical costs and trends. Additionally, the prices take into account the contractual agreements with key customers. In many cases, sales prices for units are negotiated in advance through manufacturing or production agreements. Any changes in the actual prices of units sold could have significant implications for the earned revenues and the repayment of the EB-5 Loan.

Production Yield

Production yield is a metric obtained by dividing the number of good parts produced by the total number of parts initiated in production. It represents the percentage of items produced that meet the quality or specification requirements of customers. Items that break during manufacturing, fail to meet quality standards, or require rework may not be sold to end customers. In 2023, the production yield for tanks is estimated to be 73%, while bowls are expected to have a yield of 76%. By 2024, both tanks and bowls are projected to achieve a production yield of 82%. Thereafter, a production yield of 90% is anticipated. Over time, production yields may improve as production processes are reviewed and optimized. The entire facility will incorporate complete robotic movement for all goods and processes, eliminating the need for human lifting or labor during production and final assembly. This automation reduces human error and enhances production efficiency.

Changes in the actual production yield could significantly impact the number of units sold, revenues earned, and the repayment of the EB-5 Loan.

Production Levels

The financial projections assumes that the quantity of units produced aligns with the capacity of the facility. This capacity is determined by factors such as the number of molds, casts per hour, and working days per year. Consequently, any deviations in the number of molds, casts, or operational days will affect the production and sale of units. As a result, alterations in the facility’s capacity will influence production levels and may have significant ramifications for the units sold, revenues earned, and the repayment of the EB-5 Loan.

Sales Units

The financial projections operates under the assumption that all units produced and packaged (after applying the production yield) will be sold to end consumers. It is important to note that AIB has successfully secured key production and manufacturing agreements with customers. According to the Inaugural Update on the Project Status, dated October 7, 2022, significant milestones have been achieved in terms of sales levels. Contracts have been signed with prominent entities such as Briggs, Menards, and Clayton Homes, collectively accounting for 50% of the production capacity. Additionally, several customers have standing orders for increased purchases as production capacity expands, and AIB has also secured a contract with a wholesaler for the production of private-label brands.

Any deviations in the number of units sold compared to the budget can have significant implications for the revenues earned and the repayment of the EB-5 Loan.