Highlights:

Area Invested In: High Unemployment I-526E Processing: Normal Investment Amount: $800,000

Admin Fee: $0 Total EB-5 Raise: $12,800,000 Total Project Cost: $27,000,000

Investment Term: 5 Years Target Investor Return: 1% Annual Return

Required Jobs: 160 Estimated Jobs: 210 Job Cushion: 31%

Offering Description:

American Industrial Brands Fund 1, LLC is raising EB-5 capital to fund the expansion of a manufacturing facility for sanitary fixtures such as bathroom fixtures, sinks, toilet bowls, bathtubs, and related parts in Kokomo, Indiana (the “Project”). The Project includes expanding an existing facility, which spans 335,000 square feet, to produce between 850,000 and 1.1 million units per year for distribution.

The Project will supply private-label sanitary fixtures to major big-box retailers and related entities on a multi-year contract basis. Manufacturing at the facility will involve three highly modernized processes: porcelain, acrylic, and plastics, which will make use of robotics and the latest technological advancements.

The Project company, American Industrial Brands, is one of two domestic manufacturers producing and supplying domestically manufactured products. They also currently operate multiple distribution centers across the United States (U.S.).

Target Employment Area Designation

The Project location qualifies as a High-Unemployment Targeted Employment Area (“TEA”) as the location has an unemployment rate that exceeds 150% of the U.S. national average unemployment rate, which currently stands at 5.4%.

The Project’s location has an unemployment rate of 9.9% and therefore qualifies as a TEA, subject to the decreased investment amount of $800,000 (the “Capital Contribution”) and allows investors to get access to the visas set-aside for this category (10% of the total EB-5 visas).

Market Opportunity

Many manufacturers in the U.S. that had previously outsourced production to foreign countries for cost-saving purposes are now reshoring their operations. To ensure successful relocation, manufacturers must embrace modern technology to bridge labor gaps and reduce costs, thereby maintaining competitiveness. The Project’s facility employs state-of-the-art robotics for product manufacturing, resulting in decreased labor costs and shorter production times.

In addition, Indiana, being a “right-to-work” state, has a labor force that is not unionized, leading to lower labor costs. These two factors, combined with a vertically integrated manufacturing process, contribute to higher profit margins.

Government Support

The Project is making use of funds from the New Market Tax Credit Program (“NMTC”). This program offers tax credits to encourage private investment in distressed communities, promoting community development and economic growth. In 2018, the NMTC was utilized during the purchase of the original facility, resulting in a receipt of $5.4 million through this program. With the additional investment required for the final phase of production, the Project is eligible to leverage these incentives and secure funding of up to $7.2 million.

Management Experience Overview

AIB is led by Robert Easter (CSO), Chuck Dockery (CEO), and Nick Quattro (CFO). Robert Easter has been actively involved in the manufacturing industry since 2004, with extensive expertise in injection molding. He spearheads the facility and financing efforts. Chuck Dockery boasts approximately 30 years of experience in the plumbing industry, having held positions in engineering, manufacturing, and serving as the CEO of Briggs Plumbing since 2011. Nick Quattro brings over 35 years of experience in finance, accounting, and distribution to the team. Having been associated with Briggs Plumbing for nearly 20 years, he has overseen various departments, including accounting and marketing.

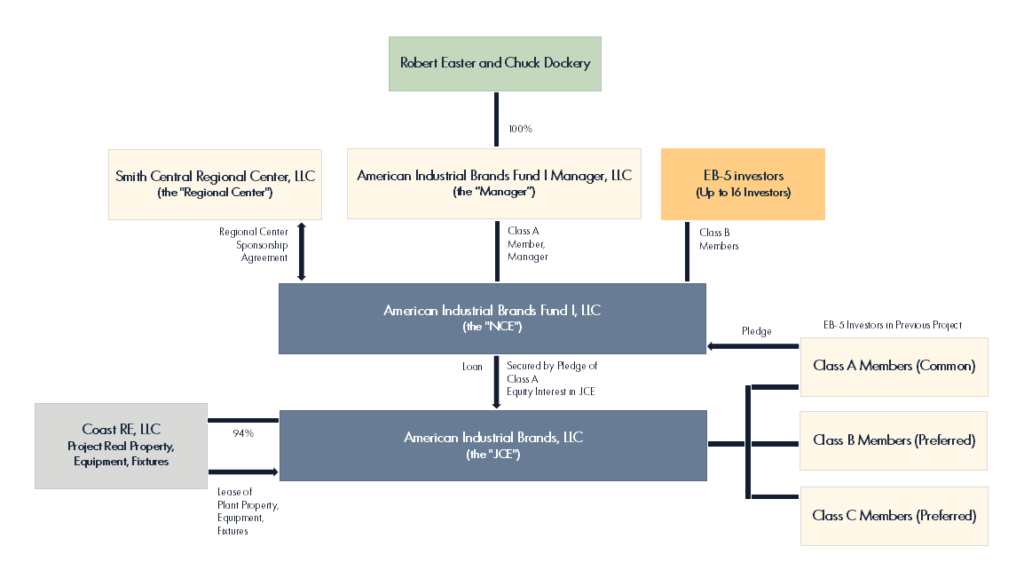

The EB-5 offering is sponsored by Steven Smith of Smith Central Regional Center, whose previous EB-5 projects encompass a hotel, an apartment building complex, and a restaurant chain.

I-526E Denial Refund

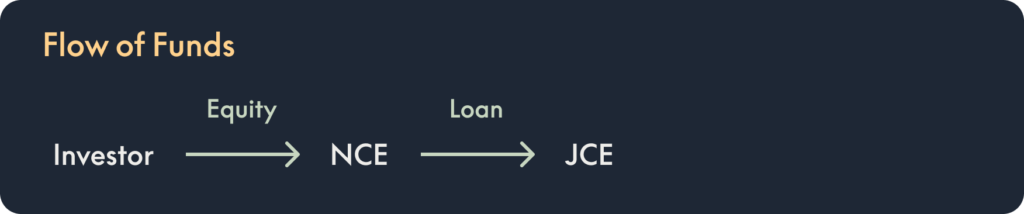

An “I-526E Denial Refund” has been provided by the new commercial enterprise (the “NCE”), American Industrial Brands Fund 1, LLC, to repay EB-5 investors in the event of denial.

Phased Investment

AIB provides its EB-5 investors with a phased investment opportunity, enabling them to make an initial contribution of $480,000 and complete the remaining payment of $400,000 within a six-month period.

Organizational Chart:

Figure 1: Organizational Chart (source: Private Placement Memorandum)